Travelers Insurance Cuts Call Center Jobs By Third

Key Points

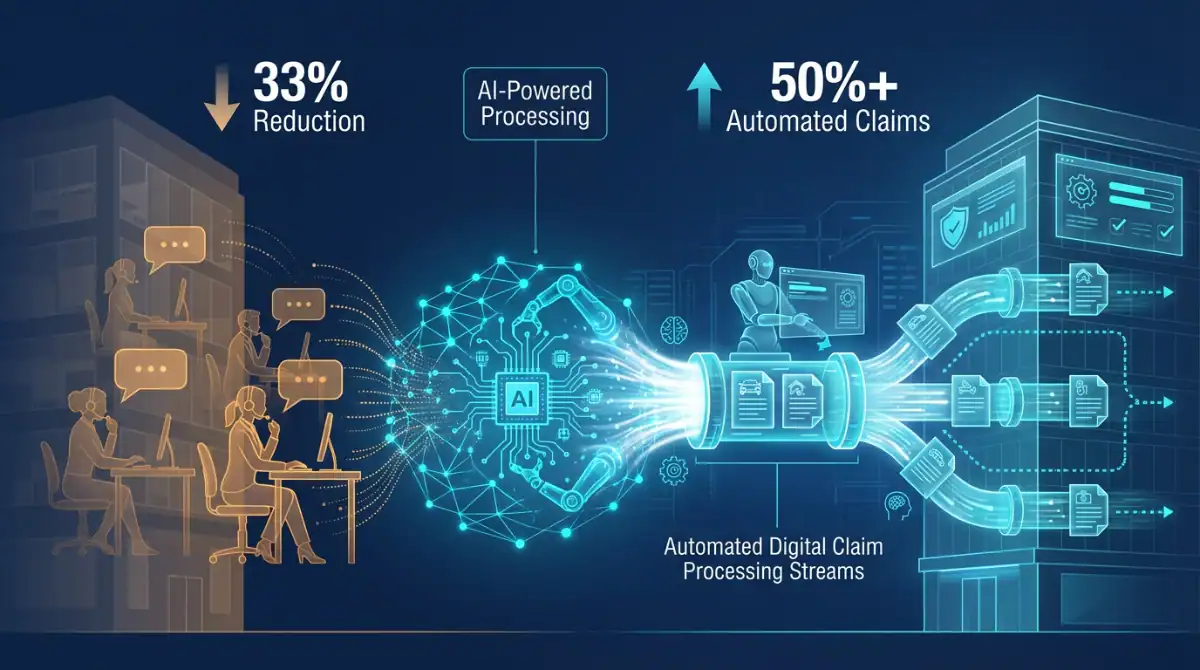

- Travelers Insurance cut call center headcount by approximately one-third through AI-powered automation

- More than half of all claims are now eligible for straight-through processing without human intervention

- Over 20,000 employees actively use AI tools across underwriting and claims operations

- Four call centers will consolidate to two as automation reshapes operational structure

- Straight-through processing handles routine claims with 66% customer adoption rate

Background

Travelers Insurance has positioned itself at the forefront of AI adoption in the insurance industry since launching its Innovation 2.0 strategy. The company’s partnership with Anthropic and deployment of generative AI tools represents one of the most comprehensive digital transformations in financial services. (ℹ️ Yahoo Finance)

The insurer has moved beyond experimental AI pilots to production-scale deployment, with dozens of generative AI applications now handling millions of transactions. This aggressive automation push aims to improve efficiency while maintaining service quality across its property and casualty insurance operations.

What Happened

During Travelers’ Q4 2025 earnings call on January 21, 2026, Chairman and CEO Alan Schnitzer revealed significant workforce restructuring driven by artificial intelligence. The company’s call center staffing in claims has decreased by approximately one-third as AI systems now handle the majority of routine inquiries and processing tasks (ℹ️ Yahoo Finance).

The reduction comes as Travelers achieves major automation milestones. More than half of all insurance claims now qualify for straight-through processing, where AI systems handle the entire workflow from submission to resolution without human intervention. When customers use these digital channels, adoption reaches about 66%, with an additional 15% of claims processed using advanced digital tools that require minimal human oversight.

Schnitzer highlighted a recently launched generative AI voice agent for first notice of loss by phone, noting that early adoption metrics exceed management expectations. The voice agent can gather initial claim information, verify coverage, and initiate processing workflows autonomously.

As a direct result of these efficiency gains, Travelers announced plans to consolidate four claims call centers down to two facilities, representing a major operational restructuring. The company emphasized that these changes reflect improved productivity rather than service reduction, with AI handling routine tasks while human agents focus on complex claims requiring nuanced judgment.

Why It Matters

Travelers’ workforce reduction signals a turning point for the insurance industry’s relationship with automation. Unlike previous technology waves that augmented workers, today’s AI systems are directly replacing call center positions that traditionally employed thousands across the sector.

The one-third reduction in call center staff demonstrates how quickly generative AI can reshape labor-intensive operations. For the broader insurance industry, Travelers’ results provide a concrete roadmap: mature AI systems can handle routine claims processing at scale, fundamentally changing workforce requirements.

From an economic perspective, this shift affects both employment patterns and competitive dynamics. Insurance companies that fail to match Travelers’ automation levels may struggle with higher operating costs. The technology has created a new competitive moat based on operational efficiency rather than traditional factors like brand recognition or distribution networks.

For employees, the implications are mixed. While call center positions are declining, Travelers reports that over 20,000 workers now use AI tools regularly, suggesting roles are evolving toward AI-assisted work rather than pure elimination. The company frames the development as freeing employees from repetitive tasks to focus on complex, high-value interactions that require human judgment.

What’s Next

Schnitzer outlined Travelers’ commitment to accelerating AI integration through its partnership with Anthropic, which provides approximately 10,000 engineers, data scientists, analysts, and product owners with “personalized, context-aware, and integrated AI assistance.”(ℹ️ Yahoo Finance)

Management expects this enhanced tooling to accelerate software and model development cycles, potentially compressing the product development timeline by up to 50% by 2027. The company continues expanding its straight-through processing capabilities to cover additional claim types and insurance products.

Industry observers anticipate other major insurers will follow Travelers’ lead, particularly as shareholders demand the operational efficiency gains demonstrated in Travelers’ Q4 results. The company reported a core income of $2.5 billion with an underlying combined ratio of 82.2%—its fifth consecutive quarter below 85%.

The broader question remains how displaced call center workers will transition. While Travelers doesn’t have detailed retraining programs, the shift toward AI-assisted roles suggests some positions may evolve rather than disappear entirely. However, the scale of reduction—from four facilities to two—indicates substantial permanent workforce changes ahead.

Source: Yahoo Finance—Published on January 21, 2026

Original article: https://finance.yahoo.com/news/travelers-companies-q4-earnings-call-180654375.htmlAuthor: Abir Benali