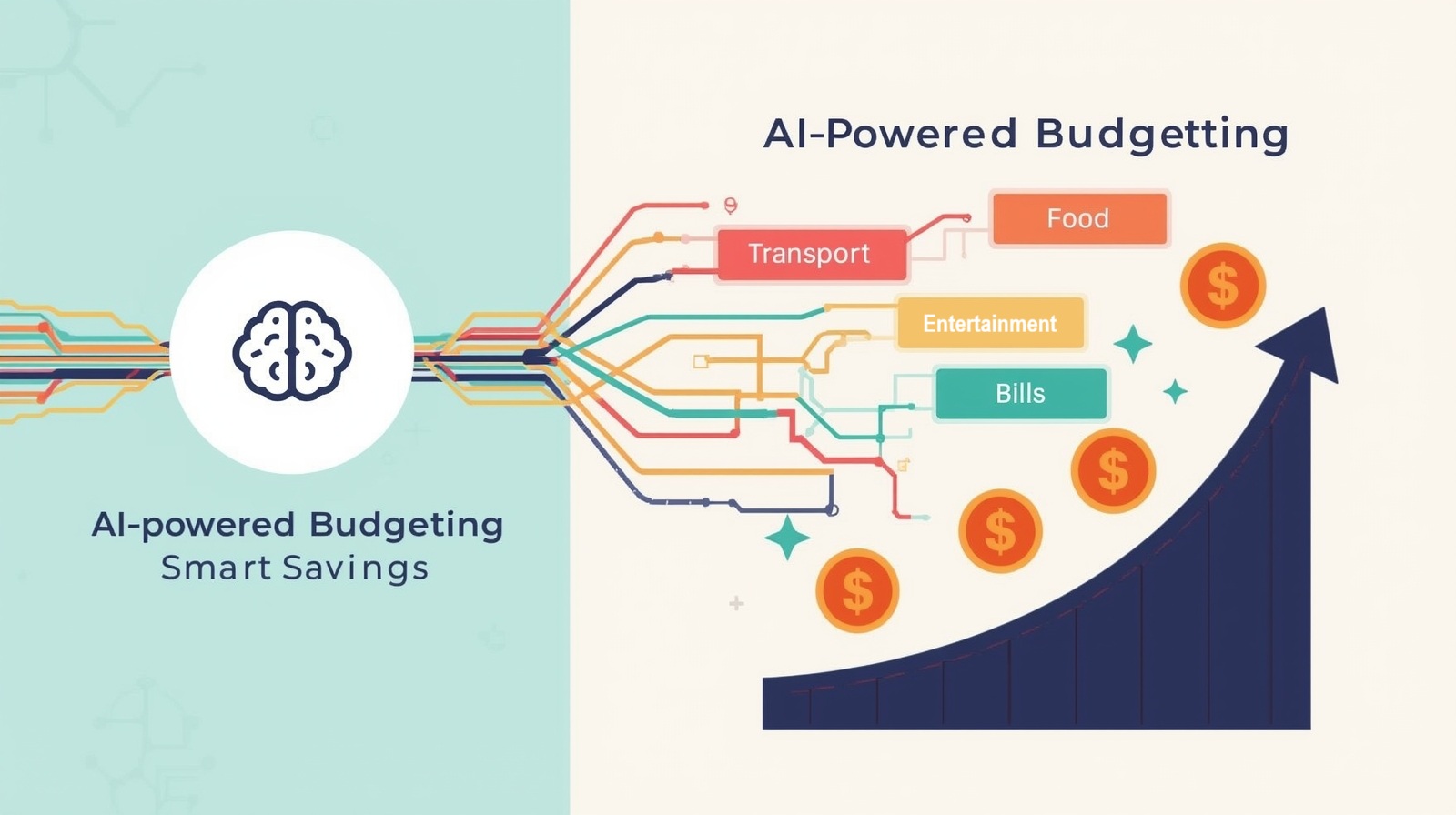

AI-Powered Budgeting: Save More with Smart Algorithms

Have you ever wondered where all your money goes each month? I used to feel the same way until I discovered AI-Powered Budgeting. Managing money can feel overwhelming, especially when you’re trying to track every expense manually. That’s where artificial intelligence steps in to transform how we handle our finances. AI-powered budgeting tools use smart algorithms to automatically analyze your spending patterns, categorize transactions, and create personalized budgets that actually work for your lifestyle. In this article, I’ll walk you through how these intelligent systems maximize your savings without requiring you to become a financial expert.

What Is AI-Powered Budgeting?

AI-Powered Budgeting refers to financial management systems that use artificial intelligence and machine learning algorithms to help you manage money more effectively. Instead of manually entering every purchase into a spreadsheet, these smart tools connect directly to your bank accounts and credit cards, automatically categorizing your transactions and identifying spending patterns you might never notice on your own.

Think of it as having a personal financial advisor who never sleeps, constantly monitoring your money flow and alerting you to opportunities for saving. The AI learns from your behavior over time, getting smarter about what’s normal for you and what represents unusual spending.

How Does It Differ from Traditional Budgeting?

Traditional budgeting requires you to manually track expenses, create categories, and stick to predetermined limits. It’s time-consuming and easy to abandon when life gets busy. AI budgeting tools automate most of this work, using machine learning algorithms to adapt to your changing circumstances and provide real-time insights.

The key difference? Traditional budgets are static—you set them once and hope they work. AI-powered systems are dynamic, continuously adjusting recommendations based on your actual behavior and financial goals.

How AI Algorithms Analyze Your Spending Patterns

The magic behind AI-Powered Budgeting starts with data collection. When you connect your financial accounts, the AI immediately begins analyzing your transaction history, typically looking back several months to understand your spending baseline.

Transaction Categorization

AI algorithms use natural language processing to read transaction descriptions and automatically sort them into categories like groceries, dining out, transportation, entertainment, and utilities. I remember being amazed when my budgeting app correctly identified a vague charge from a local restaurant I’d never told it about. The system had learned to recognize merchant names and even abbreviations.

This categorization happens instantly and accurately, something that would take hours if done manually. The AI also learns from corrections—if you move a transaction to a different category, it remembers for next time.

Pattern Recognition and Anomaly Detection

Once your transactions are categorized, the AI identifies patterns in your spending behavior. It notices things like:

- Regular monthly subscriptions you might have forgotten about

- Increased spending in certain categories during specific times of the month

- Unusual purchases that deviate from your typical behavior

- Seasonal variations in your expenses

I discovered I was paying for three streaming services I rarely used, all charging on different dates. The AI flagged these as potential savings opportunities, and canceling them freed up over $35 monthly—that’s more than $400 annually.

Predictive Analytics for Future Spending

AI budgeting algorithms don’t just look backward; they predict forward. By analyzing your historical patterns, these systems forecast your upcoming expenses, helping you prepare for bills and avoid overdrafts. If the algorithm notices you typically spend more on groceries at the end of the month, it’ll factor that into your available budget calculations.

Creating Personalized Budgets with AI

Generic budgets fail because everyone’s financial situation is unique. AI-Powered Budgeting excels at personalization, creating budgets tailored specifically to your income, expenses, goals, and spending habits.

Income-Based Budget Recommendations

The AI starts by understanding your income streams—salary, freelance work, side hustles, or passive income. It then applies proven budgeting frameworks like the 50/30/20 rule (50% needs, 30% wants, 20% savings) but adjusts the percentages based on your actual spending history and local cost of living.

For someone living in an expensive city with high rent, the AI might recommend a 60/25/15 split instead. The system adapts to your reality rather than forcing you into a one-size-fits-all approach.

Goal-Oriented Budget Adjustments

When you set financial goals—like saving for a vacation, building an emergency fund, or paying off debt—the AI recalibrates your budget to make these goals achievable. It identifies areas where you can comfortably reduce spending without drastically changing your lifestyle.

I set a goal to save $3,000 for a home renovation project. My AI budgeting tool analyzed six months of data and suggested I could reach this goal in eight months by reducing dining out by 30% and redirecting those funds to savings. The specific, actionable recommendation made the goal feel attainable rather than overwhelming.

Dynamic Budget Rebalancing

Life changes, and your budget should too. AI algorithms continuously monitor your spending and automatically adjust budget allocations when they detect sustained changes in your behavior or circumstances.

If you start a new job with a longer commute, the AI notices increased transportation costs and rebalances your budget accordingly, perhaps suggesting reductions in other discretionary categories to maintain your savings rate.

Identifying Hidden Savings Opportunities

One of the most powerful features of AI-Powered Budgeting is its ability to uncover savings opportunities you’d never spot on your own. These algorithms excel at finding money leaks in your finances.

Subscription Audit and Management

The average person pays for multiple subscriptions they’ve forgotten about or rarely use. AI budgeting tools automatically identify all recurring charges and evaluate their usage based on your transaction patterns.

My budgeting app discovered I was paying for a gym membership I hadn’t used in four months (the AI noticed no transactions at the gym location), a magazine subscription that arrived unread, and software I’d replaced with a free alternative. Canceling these saved me $87 monthly.

Spending Pattern Optimization

AI algorithms identify inefficient spending patterns and suggest smarter alternatives. For instance, if you’re buying lunch out five days a week, the AI calculates exactly how much you’re spending annually and shows the dramatic savings potential of meal prepping just two days per week.

The key is specificity. Instead of vague advice like “spend less on food,” AI provides concrete recommendations: “You spent $420 on takeout last month. Reducing to 8 times monthly would save $210, or $2,520 annually.”

Bill Negotiation Insights

Some advanced AI budgeting platforms analyze your utility bills, insurance premiums, and subscription costs against market rates. They alert you when you’re paying above average and sometimes even negotiate better rates on your behalf.

I received an alert that my internet bill was 23% higher than similar plans in my area. Armed with this data, I contacted my provider and negotiated a $15 monthly reduction—an effortless $180 annual savings.

Cashback and Rewards Optimization

AI systems can track which credit cards offer the best rewards for your specific spending categories. If you’re using a flat 1% cashback card for everything but spend heavily on groceries, the AI might suggest switching to a card offering 3% on supermarket purchases.

This category-specific optimization can add hundreds of dollars annually in rewards you’re currently leaving on the table.

Real-Life Examples of AI Maximizing Savings

Example 1: The Young Professional

Sarah, a 28-year-old marketing specialist, connected her accounts to an AI budgeting app in January. Within the first month, the system identified:

- Three unused subscriptions costing $42 monthly

- Excessive dining out spending ($380 monthly average)

- An opportunity to refinance her car loan at a lower rate

By following the AI’s recommendations—canceling subscriptions, reducing restaurant visits by 40%, and refinancing—Sarah increased her monthly savings from $150 to $485. Over a year, that’s an additional $4,020 in savings, primarily from optimizations she never would have calculated manually.

Example 2: The Busy Parent

Marcus, a father of two, struggled to maintain a budget between work, childcare, and household management. An AI-powered budgeting tool automated his financial tracking and revealed that impulse purchases during grocery shopping added $150 monthly to his food costs.

The AI suggested ordering groceries online with a preset list, reducing impulse buys. It also identified that switching to annual payments for insurance policies would save 8% through bulk payment discounts. These changes freed up $240 monthly, which Marcus redirected to his children’s education fund.

Example 3: The Freelancer with Variable Income

Jessica’s freelance income fluctuated dramatically month to month, making traditional budgeting nearly impossible. Her AI budgeting algorithm analyzed income patterns over 18 months and created a flexible budget based on her average monthly earnings rather than individual months.

The system automatically adjusted spending limits during high-earning months (suggesting increased savings) and low-earning months (prioritizing essential expenses). This intelligent approach helped Jessica save 22% of her income—significantly higher than the 12% she managed with manual budgeting.

How to Get Started with AI-Powered Budgeting

Starting your journey with AI-Powered Budgeting is simpler than you might think. You don’t need technical expertise—just a willingness to let technology help manage your finances.

Step 1: Choose the Right AI Budgeting Tool

Several excellent AI budgeting apps are available, each with different features and pricing models. Popular options include:

- YNAB (You Need A Budget): Offers goal-tracking and automatic transaction importing with smart categorization

- Mint: Free tool with AI-powered insights and bill tracking

- PocketGuard: Focuses on showing how much disposable income you have after bills and goals

- Quicken: Comprehensive financial management with investment tracking

- Simplifi by Quicken: Streamlined interface with intelligent spending reports

Research which tool aligns best with your needs. I recommend starting with a free option like Mint to experience AI budgeting before committing to a paid subscription.

Step 2: Connect Your Financial Accounts

Once you’ve selected a tool, you’ll need to securely connect your bank accounts, credit cards, and any other financial accounts. The AI needs access to transaction data to provide meaningful insights.

Most platforms use bank-level encryption and read-only access, meaning the app can see your transactions but cannot move money or make purchases. Still, verify the security measures of any app before connecting accounts—look for two-factor authentication and strong privacy policies.

Step 3: Set Your Financial Goals

Tell the AI what you’re working toward. Are you building an emergency fund? Saving for a vacation? Paying off debt? Clear goals help the AI algorithm provide more targeted recommendations and adjust your budget to support these objectives.

Be specific with timelines and amounts. Instead of “save more money,” try “save $5,000 for an emergency fund within 12 months.” Specific goals allow the AI to reverse-engineer exactly how much you need to save monthly and where that money can come from.

Step 4: Review and Refine Initial Categorizations

The AI will automatically categorize your transactions, but spend a few minutes reviewing its work during the first week. Correct any miscategorizations so the system learns your preferences. This initial training significantly improves accuracy going forward.

I spent about 20 minutes reviewing my first month of transactions. After those corrections, my AI budgeting tool achieved over 95% categorization accuracy—saving me hours of manual work each month.

Step 5: Implement AI Recommendations Gradually

Your AI budgeting tool will likely suggest multiple changes. Don’t try to implement everything at once. Start with the easiest, highest-impact recommendations—like canceling unused subscriptions—before tackling behavioral changes like reducing dining out.

Gradual implementation prevents budget fatigue and increases your likelihood of maintaining these positive changes long-term.

Step 6: Monitor Progress and Adjust

Check your budget dashboard weekly at first, then shift to biweekly as the system becomes more familiar. The AI learns from your continued behavior, so regular use improves its recommendations.

Celebrate wins when you hit savings milestones. I set up notifications for when I reached savings goals, and those little victories kept me motivated to continue optimizing my spending.

Understanding AI Budgeting Technology

For those curious about what’s happening under the hood, let’s explore the technology powering AI-Powered Budgeting tools without getting too technical.

Machine Learning in Financial Management

Machine learning is a type of AI that improves automatically through experience. In budgeting apps, these algorithms analyze thousands or millions of transactions to identify patterns and make predictions.

When you first connect your accounts, the AI might incorrectly categorize some transactions. But as you make corrections, it learns the unique characteristics of your spending and becomes increasingly accurate. This learning process is continuous—the more you use the tool, the smarter it becomes.

Natural Language Processing for Transaction Analysis

Natural language processing (NLP) allows AI to understand the messy, inconsistent transaction descriptions from banks and credit cards. Where you might see “SQ *COFFEE SHOP #1234,” the NLP algorithm recognizes this as a coffee purchase and categorizes it appropriately.

This technology is what makes automatic categorization possible, saving you from manually sorting hundreds of transactions monthly.

Predictive Analytics and Forecasting

The AI doesn’t just look at past spending—it forecasts future expenses using predictive analytics. By analyzing historical patterns, seasonal trends, and upcoming bills, these systems warn you about potential cash flow issues before they occur.

If the algorithm predicts you’ll overspend your grocery budget based on current trends, it alerts you mid-month when you still have time to adjust, rather than after you’ve already exceeded the limit.

Security and Privacy Considerations

When trusting AI with your financial data, security and privacy are paramount concerns. Here’s what you need to know to use AI budgeting tools safely.

Data Encryption and Protection

Reputable AI-powered budgeting platforms use bank-level encryption (typically 256-bit encryption) to protect your data both in transit and at rest. This is the same security standard used by financial institutions.

Additionally, most services use “read-only” access to your accounts, meaning they can view transactions but cannot initiate transfers or payments. They also don’t store your actual banking credentials—instead, they use secure token-based authentication through services like Plaid or Yodlee.

Privacy Policies and Data Sharing

Before connecting accounts, carefully review the app’s privacy policy. Understand what data is collected, how it’s used, and whether it’s shared with third parties. Some free apps monetize by selling aggregated, anonymized data to financial institutions.

This isn’t necessarily problematic—your individual information remains private—but you should know how your data contributes to the business model. If you’re uncomfortable with any aspect of data sharing, look for paid services that explicitly don’t sell user data.

Best Practices for Safe AI Budgeting

Follow these guidelines to maximize security:

- Enable two-factor authentication on both your budgeting app and connected financial accounts

- Use strong, unique passwords for each account

- Regularly review connected accounts and remove any you no longer use

- Monitor your bank statements independently of the budgeting app to catch any unauthorized activity

- Keep your app updated to ensure you have the latest security patches

- Log out on shared devices and avoid accessing financial apps on public Wi-Fi

I use a password manager to generate and store unique passwords for every financial account and enable biometric authentication whenever available. These simple steps significantly reduce security risks.

Common Mistakes to Avoid

Even with AI doing most of the heavy lifting, there are common pitfalls that can undermine your AI-Powered Budgeting success.

Mistake 1: Not Connecting All Accounts

For the AI to provide accurate insights, it needs a complete financial picture. Leaving out a credit card or secondary bank account creates blind spots in your budget and leads to inaccurate recommendations.

I initially only connected my primary checking account, wondering why my budget never seemed to balance. Once I added my credit card (which I used to make most purchases for rewards), the AI’s analysis became dramatically more useful.

Mistake 2: Ignoring AI Recommendations

The algorithm can identify savings opportunities, but you still need to act on them. I’ve seen people diligently check their budgeting app but never cancel the subscriptions it flags or reduce spending in over-budget categories.

Set a weekly reminder to review recommendations and implement at least one suggestion. Small, consistent actions compound into significant savings over time.

Mistake 3: Setting Unrealistic Goals

If the AI suggests you can save $1,000 monthly but your current savings rate is $50, don’t blindly follow that recommendation without understanding the required sacrifices. Unrealistic goals lead to frustration and abandonment.

Instead, work with the AI to create a stepping-stone approach—maybe start by increasing savings to $150 monthly, then $300, gradually building toward larger goals.

Mistake 4: Forgetting to Update Life Changes

When major life events occur—new job, move, marriage, children—manually update your budgeting tool with this information. While AI is smart, it can’t immediately know about changes that haven’t yet appeared in your transaction history.

After getting married, I updated my budgeting app to reflect combined finances. This allowed the AI to provide recommendations appropriate for a two-income household rather than continuing to use my single-person spending patterns.

Mistake 5: Becoming Too Dependent on Automation

AI budgeting tools are incredibly beneficial but shouldn’t replace basic financial literacy. Understand the fundamentals of budgeting, savings, and investing so you can evaluate whether AI recommendations make sense for your specific situation.

The AI provides data and suggestions; you provide the human judgment about what truly matters in your life and how you want to prioritize your money.

Frequently Asked Questions About AI-Powered Budgeting

Advanced Features in Modern AI Budgeting Tools

As AI-Powered Budgeting technology evolves, newer features continue emerging that make financial management even more effective.

Collaborative Budgeting for Households

Many AI budgeting platforms now support shared accounts, allowing couples or families to manage finances together. The AI tracks individual and joint spending, identifies who’s responsible for which expenses, and provides personalized recommendations for each person while maintaining overall household budget health.

This collaborative approach reduces financial conflicts by making spending transparent and creating objective data for household budget discussions.

Investment Tracking and Portfolio Optimization

Advanced AI budgeting tools extend beyond day-to-day spending to include investment account tracking. They monitor portfolio performance, suggest rebalancing opportunities, and even identify when you have excess cash that could be invested rather than sitting idle in checking accounts.

Some platforms analyze your risk tolerance based on spending patterns and age, then recommend appropriate investment allocations to grow your wealth alongside your budgeting efforts.

Bill Negotiation Services

Certain AI-powered platforms include automated bill negotiation features. The AI identifies services where you’re likely paying too much—cable, internet, phone plans, insurance—and either provides you with competitive pricing data or actually negotiates with providers on your behalf.

This feature alone can save hundreds annually with minimal effort on your part. The AI monitors market rates continuously, alerting you whenever better deals become available.

Smart Alerts and Notifications

Modern AI budgeting algorithms send intelligent, context-aware notifications rather than generic alerts. Instead of just warning you’ve exceeded your restaurant budget, the AI might say, “You’re 80% through your dining budget with 10 days left this month. Based on your patterns, you typically spend $120 more. Consider cooking at home to stay on track.”

These specific, actionable alerts are far more useful than simple overspending warnings.

The Future of AI-Powered Budgeting

The AI budgeting landscape continues evolving rapidly. Here’s what’s on the horizon:

Voice-Activated Budget Management

Integration with voice assistants like Alexa, Google Assistant, and Siri is becoming more sophisticated. Soon, you’ll ask your voice assistant for spending summaries, budget updates, and savings recommendations without opening an app.

Predictive Shopping Recommendations

Future AI systems will analyze your consumption patterns and predict when you’ll need to repurchase items, suggesting optimal times to buy based on price trends and your usage rates. This proactive approach prevents both overstocking and emergency purchases at premium prices.

Integration with Employer Benefits

AI-powered budgeting platforms are beginning to integrate with employer payroll systems, automatically optimizing contributions to 401(k)s, HSAs, and other pre-tax accounts based on your spending patterns and savings goals. This seamless integration maximizes tax advantages without requiring financial expertise.

Behavioral Economics Integration

The most advanced systems are incorporating principles from behavioral economics—understanding not just what you spend, but why. These AI tools will identify emotional spending triggers and suggest healthier coping mechanisms, making budgeting as much about psychological well-being as financial health.

Taking Control of Your Financial Future

AI-Powered Budgeting represents a fundamental shift in personal finance management. It transforms budgeting from a tedious, error-prone manual process into an automated, intelligent system that works continuously in your best financial interest.

The technology isn’t about removing human judgment from financial decisions—it’s about augmenting your capabilities with data-driven insights you’d never discover on your own. The AI spots patterns, predicts problems, and suggests optimizations while you maintain full control over which recommendations to implement.

Starting your AI budgeting journey doesn’t require financial expertise or technical skills. Choose a platform that matches your needs, connect your accounts, set meaningful goals, and let the algorithm begin its work. Within weeks, you’ll likely discover money leaks you never knew existed and opportunities for savings you never thought possible.

The key to success is consistency. Check your budgeting dashboard regularly, implement AI recommendations that align with your values and priorities, and adjust as your life circumstances change. The AI becomes more valuable over time as it learns your unique financial personality and refines its suggestions.

Financial stress affects millions of people, but AI-Powered Budgeting offers a practical path toward greater financial security and peace of mind. You don’t need to become a financial expert or spend hours managing spreadsheets. You just need to let intelligent algorithms do what they do best—analyze data, identify patterns, and provide personalized guidance.

Your financial future is too important to manage with guesswork and outdated methods. Embrace the power of artificial intelligence to maximize your savings, eliminate wasteful spending, and build the financial foundation you deserve. The technology is ready—the question is, are you ready to let AI help you achieve your financial goals?

References:

Plaid: Financial Data Connectivity and Security Standards

Consumer Financial Protection Bureau: Best Practices for Financial App Security

Journal of Financial Planning: Impact of Automated Budgeting on Savings Rates

National Endowment for Financial Education: Personal Finance Technology Adoption Studies

About the Author

Abir Benali is a friendly technology writer passionate about making AI tools accessible to everyone. With years of experience explaining complex technology in simple terms, Abir specializes in helping non-technical users discover how AI can simplify daily tasks. Through clear, step-by-step guides and practical examples, Abir has helped thousands of readers confidently embrace AI tools to improve their lives. When not writing about technology, Abir enjoys exploring new apps, testing emerging AI platforms, and finding creative ways to make digital tools more user-friendly for everyday people.