How to Track Churn Prevention & LTV Metrics Using AI

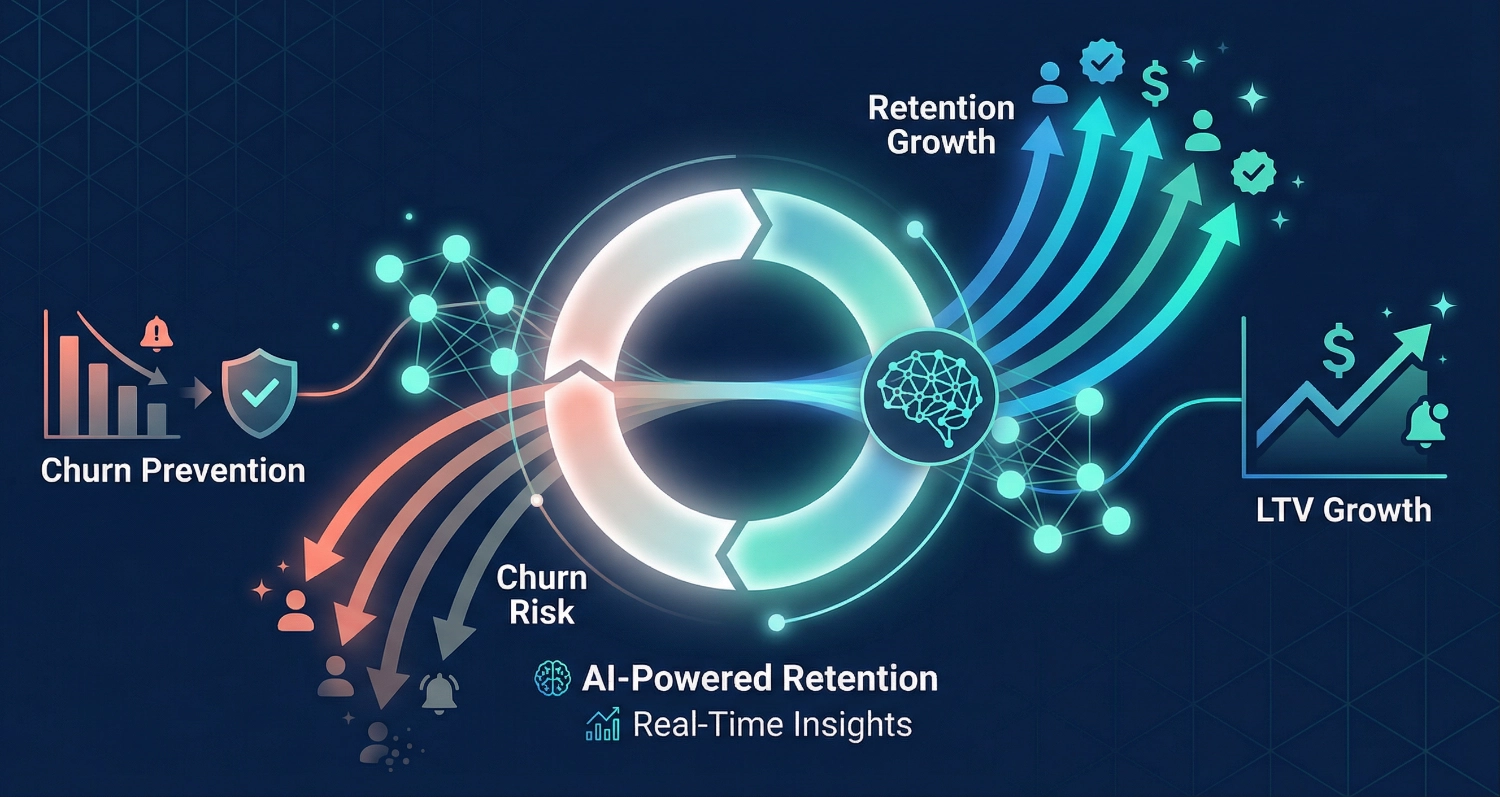

How to Track Churn Prevention & LTV Metrics Using AI starts with understanding one simple truth: losing customers costs far more than keeping them happy. We’ve both experienced that sinking feeling when a valued customer disappears without warning. But here’s the exciting part—AI has transformed how we can predict, prevent, and reverse churn before it happens.

In this guide, we’re sharing the exact process we use to track critical churn prevention metrics and lifetime value (LTV) indicators using AI-powered tools. Whether you’re running a subscription service, e-commerce store, or service-based business, these methods will help you spot warning signs early and take action that actually works.

Why AI Changes Everything for Churn Prevention

Traditional churn tracking meant staring at spreadsheets full of numbers that only told you what already happened. By the time you noticed a pattern, customers were already gone. AI-powered churn prevention works differently—it identifies subtle behavioral shifts in real-time, predicts which customers are at risk, and even suggests personalized interventions.

We remember analyzing customer data manually, spending hours trying to find patterns. Now, AI tools process thousands of data points instantly, revealing insights we’d never spot on our own. The difference isn’t just efficiency; it’s the ability to act preventively instead of reactively.

Understanding the Core Metrics You’ll Track

Before diving into the how-to steps, let’s clarify what we’re actually measuring:

Net Promoter Score (NPS): Measures customer satisfaction and likelihood to recommend. AI can track NPS trends across segments and predict which detractors might churn soon.

Retention Rate: The percentage of customers who stay with you over time. AI identifies which behaviors correlate with higher retention.

Customer Lifetime Value (LTV): Total revenue you can expect from a customer relationship. AI predicts future LTV based on current behavior patterns.

Delight Moments: Positive interactions that strengthen customer bonds. AI helps identify and replicate these experiences.

Education Cadence: How well customers engage with onboarding and learning resources. AI reveals optimal timing and content.

Step-by-Step: Setting Up AI-Powered Churn Tracking

Step 1: Choose Your AI Analytics Platform

Start by selecting a platform that connects to your existing customer data. We recommend tools that integrate with your CRM, payment processor, and support systems.

Popular options include platforms with built-in AI churn prediction models. Look for features like:

- Automated data collection from multiple sources

- Predictive scoring for churn risk

- Visual dashboards for quick insights

- Custom alert systems

Don’t worry about getting the “perfect” tool immediately. Start with one that fits your budget and offers a free trial. You can always upgrade as you learn what features matter most for your business.

Step 2: Connect Your Data Sources

The magic of AI happens when it can see the complete customer picture. Connect these data sources:

Transaction data: Purchase history, subscription status, payment methods

Engagement data: Login frequency, feature usage, support tickets

Communication data: Email opens, survey responses, feedback forms

Behavioral data: Time spent, pages viewed, actions taken

Most AI platforms offer one-click integrations or simple CSV uploads. We typically spend 30–60 minutes on the initial setup, then the system runs automatically.

Pro tip: Start with your most critical data source (usually your CRM or payment system), then add others gradually. You’ll see valuable insights even before everything is connected.

Step 3: Define Your Baseline Metrics

Your AI system needs context to understand what’s normal versus concerning. Spend a week collecting baseline data for:

- Average customer retention rate per cohort

- Typical NPS scores across customer segments

- Standard engagement patterns for healthy accounts

- Common drop-off points in your customer journey

We’ve found that manually reviewing 20-30 customer profiles helps us recognize patterns the AI should watch for. This human review creates better training data for your AI model.

Step 4: Set Up Predictive Churn Scoring

Now configure your AI to assign risk scores to each customer.

Most platforms use a 0-100 scale where:

- 0-30: Healthy, engaged customers

- 31-60: Moderate risk, needs monitoring

- 61-100: High risk, immediate action needed

The AI calculates these scores by analyzing hundreds of variables simultaneously—something impossible to do manually. We check our dashboard every morning, focusing first on customers who’ve moved into higher risk categories overnight.

Step 5: Create Automated NPS Tracking Workflows

Net Promoter Score tracking becomes powerful when AI handles the timing and segmentation. Here’s how we set this up:

Configure your AI to send NPS surveys based on behavioral triggers, not arbitrary schedules:

- After major product interactions

- When usage patterns change significantly

- Following support resolutions

- At renewal milestones

The AI learns optimal survey timing by analyzing response rates.

We’ve seen our NPS response rates jump from 12% to 34% simply by letting AI choose when to ask.

Once responses come in, your AI should automatically:

- Categorize customers as promoters (9-10), passives (7-8), or detractors (0-6)

- Flag detractors for immediate follow-up

- Identify common themes in open-ended responses

- Correlate NPS changes with churn risk scores

Common mistake to avoid: Don’t survey customers too frequently. AI can prevent survey fatigue by tracking how recently someone was asked and adjusting timing accordingly.

Step 6: Monitor Retention Rate Patterns

Retention rate monitoring with AI goes beyond simple month-over-month comparisons. Set up tracking for:

Cohort retention: Group customers by signup month and track how each cohort performs over time. AI spots when specific cohorts underperform, helping you identify problematic onboarding periods.

Feature-based retention: Which features correlate with better retention? AI analyzes usage patterns to reveal your “sticky” features—the ones that keep customers coming back.

Segment retention: Track retention across customer types, pricing tiers, or geographic regions. We discovered our enterprise customers had different retention patterns than SMBs, requiring separate prevention strategies.

Your AI dashboard should visualize retention curves, making drop-off points instantly visible. When we check ours, we look for any downward curves that weren’t there last week.

If you’re finding this process helpful so far, we recommend grabbing our Customer Engagement & Appreciation Checklist to ensure you’re implementing all the key retention touchpoints that complement your AI tracking system. It’s a practical companion that helps you act on the insights AI reveals.

Step 7: Calculate and Predict LTV Metrics

Lifetime value (LTV) tracking transforms from backward-looking math to forward-looking prediction with AI. Here’s the setup process:

Configure your AI to calculate current LTV using your business formula. Most subscription businesses use: LTV = (Average Revenue Per User × Gross Margin) ÷ Churn Rate

But AI goes further by predicting future LTV based on current behavior. The system identifies high-value behavioral patterns and flags when customers start deviating.

We set up custom alerts for:

- Customers whose predicted LTV drops by more than 20%

- High-value accounts showing early warning signs

- Upsell opportunities for LTV could increase with proper nurturing.

The practical value? We can justify spending more on retention for high-LTV customers while optimizing efforts for others. AI makes these decisions data-driven instead of gut-based.

Step 8: Identify and Track Delight Moments

Delight moments are those unexpected touches that transform satisfied customers into loyal advocates. AI helps you systematically create and track these experiences.

Set up your AI to recognize successful delight patterns:

- Support interactions that receive high satisfaction ratings

- Feature discoveries that lead to increased engagement

- Educational content that triggers “aha moments”

- Personalization that resonates with specific segments

We configure our AI to track the customer journey and flag opportunities for delight. For example, when someone uses a feature for the first time successfully, the AI triggers a congratulatory message with tips for advanced usage.

The key is letting AI identify which delight moments actually impact retention versus those that feel beneficial but don’t move metrics. We review these correlations monthly and double down on what works.

Step 9: Optimize Education Cadence with AI

Customer education timing matters enormously. Send too much too soon, and you overwhelm people.

Wait too long, and they never unlock your product’s full value.

AI solves such issues by personalizing education based on:

- Current product knowledge level (derived from usage)

- Learning pace (how quickly they adopt new features)

- Role and use case: (different personas need different content)

- Engagement patterns (preferred times and channels)

We set up our AI to deliver educational content through a drip system that adapts automatically. High-engagement users get faster-paced education. Struggling users receive more foundational content with extra support offers.

Track these education metrics in your AI dashboard:

- Content consumption rates by segment

- Time-to-proficiency for key features

- Correlation between education completion and retention

- Drop-off points in educational sequences

Common mistake: Don’t assume all customers need the same education path. Let AI create personalized journeys based on behavior, not assumptions.

Step 10: Set Up Real-Time Alerts and Interventions

The final step transforms your AI tracking system from passive monitoring to active prevention. Configure alerts that notify you instantly when action is needed.

We use three alert tiers:

Critical alerts (immediate action required):

- High-value customer enters high churn risk

- NPS detractor response from key account

- Sudden drop in engagement from power user

- Payment failure on valuable subscription

Medium alerts (action within 24 hours):

- Customer misses important onboarding milestone

- Usage drops below healthy threshold

- Support ticket unresolved beyond SLA

- Educational content repeatedly ignored

Low alerts (monitor and plan):

- Gradual engagement decline over weeks

- Feature usage doesn’t match customer segment

- Passive NPS response from previously satisfied customer

Connect these alerts to your CRM or communication tools so the right team members get notified automatically. We’ve found that the fastest way to prevent churn is having the right person reach out within hours of a critical alert.

Advanced AI Strategies for Power Users

Once you’ve mastered the basics, these advanced techniques amplify your results:

Cohort Analysis with Predictive Modeling

Don’t just track cohorts—use AI to predict how current cohorts will perform months from now. This helps you allocate the retention budget more effectively and spot problems before they cascade.

Sentiment Analysis on Support Tickets

AI can analyze the emotional tone of customer communications, flagging frustration before it becomes churn. We review sentiment trends weekly, addressing systemic issues that drive negative experiences.

Behavioral Clustering

Let AI group customers by behavior patterns rather than demographics. We discovered “power users who never contact support” are a distinct segment with unique retention needs—something we’d never identified manually.

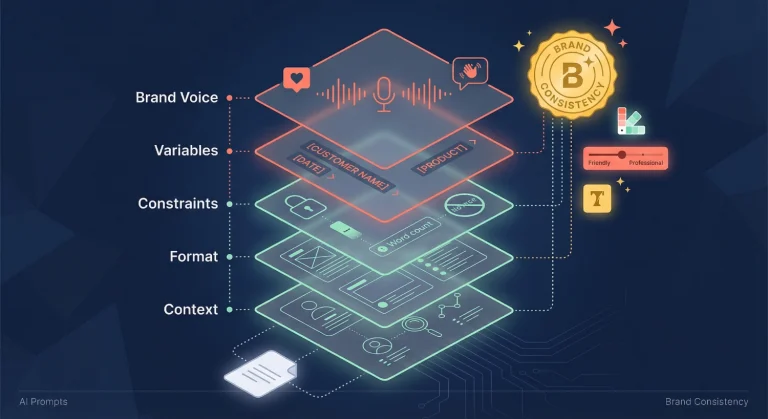

Want to take your AI-powered customer retention even further? Our 100+ AI Marketing Prompts guide includes ready-to-use templates specifically for churn prevention outreach, NPS follow-ups, and retention campaigns. These prompts have helped us craft more effective interventions that actually resonate with at-risk customers.

Measuring the Impact of Your AI Tracking System

After implementing these steps, track these success indicators:

- Early warning rate: What proportion of churned customers did AI flag in advance?

- Intervention success: When you act on AI alerts, what percentage of at-risk customers stay?

- Time savings: How many hours per week does AI save versus manual tracking?

- Revenue protected: What’s the monetary value of customers retained through AI-driven interventions?

We review these metrics monthly, celebrating wins and adjusting strategies where needed. The goal isn’t perfect prediction—it’s meaningful improvement over your previous approach.

Common Challenges and How to Overcome Them

Challenge: Too many alerts overwhelming your team

Solution: Start with only critical alerts, then gradually add others as you build response capacity

Challenge: AI predicts churn, but you’re unsure how to intervene

Solution: Create a simple playbook with 3-5 proven intervention tactics, then refine based on what works

Challenge: Data quality issues affecting AI accuracy

Solution: Focus on cleaning one data source at a time rather than trying to fix everything at once

Challenge: Team resistance to AI-driven decisions

Solution: Run AI recommendations parallel to human judgment for a month, comparing results to build trust

We’ve encountered all of these ourselves. The key is treating AI as a learning partner, not a replacement for human judgment. The best results come from combining AI insights with empathetic human touch.

Frequently Asked Questions

Your Next Steps: From Reading to Doing

We’ve covered a lot of ground, but the most important step is the one you take next. Here’s your action plan:

This week: Choose one AI analytics platform and sign up for a free trial. Connect your primary data source and set up basic churn risk scoring.

Next week: Configure your first automated alert for high-risk customers. When an alert fires, reach out personally to that customer and document what happens.

This month: Add NPS tracking and review your first full dataset. Identify your top three churn risk factors and create simple intervention strategies for each.

Next quarter: Measure your baseline improvement. Calculate how much revenue you’ve protected and time you’ve saved. Use these numbers to justify expanding your AI tracking capabilities.

Remember, perfection isn’t the goal—progress is. We started with messy data, limited technical knowledge, and plenty of mistakes. What mattered was taking the first step and iterating from there.

The beautiful thing about AI-powered churn prevention is that it gets smarter as you use it. Every customer interaction, every successful intervention, and every pattern identified trains the system to serve you better. Six months from now, you’ll wonder how you ever managed customer retention without it.

Start small, measure everything, and let the data guide your next moves. Your customers—and your bottom line—will thank you.

About the Authors

Alex Rivera and Abir Benali collaborated to write this article, blending creative technical insight with practical, beginner-friendly guidance.

Alex Rivera (Main Author) is a creative technologist passionate about helping non-technical users harness AI for business growth. With years of experience implementing AI solutions for retention and engagement, Alex specializes in making complex technology accessible and actionable for everyday business owners.

Abir Benali (Co-Author) is a friendly technology writer dedicated to explaining AI tools in clear, jargon-free language. Abir’s approach focuses on step-by-step guidance that empowers readers to confidently implement new technologies without feeling overwhelmed.

Together, we believe AI should be a tool that enhances human creativity and judgment, not replaces it. Our goal is to equip you with practical knowledge you can apply immediately, regardless of your technical background.